Accounting Basics: T Accounts

A ledger is a complete record of all financial transactions for a company, organized by account. It includes a list of all T-accounts and their balances, providing a comprehensive view of a company’s financial position. Ledgers can be maintained manually or electronically, and they serve as the basis for financial statements and other reports. As you can see, all of the journal entries are posted to their respective T-accounts. The debits for each transaction are posted on the left side while the credits are posted on the right side.

Company

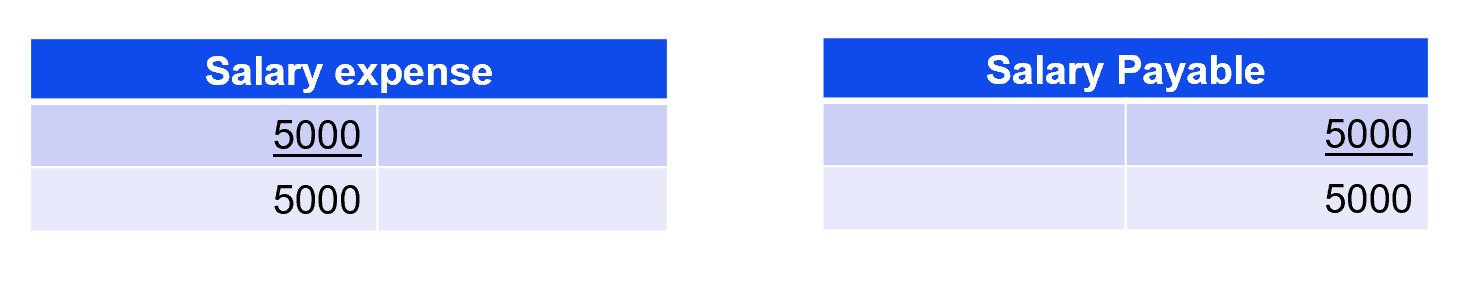

The T account shows that there will be a debit of $10,000 to the rent expense account, as well as a corresponding $10,000 credit to the accounts payable account. This initial transaction shows that the company has incurred an expense as well as a liability to pay that expense. However, since debits and credits are entered at the same time, these kinds of mistakes can be easier to catch if the accountant checks his numbers after every journal entry. A T Account is the visual structure used in double entry bookkeeping to keep debits and credits separated.

- T accounts help people understand how money moves in and out of an account.

- My income account (revenue account) is being credited £2.50, increasing its value, making the transaction balanced.

- Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

- The debit entry of an asset account translates to an increase to the account, while the right side of the asset T-account represents a decrease to the account.

- I liked seeing how curious they were about the world and being able to push them toward that curiosity.

What Are the Problems with T Accounts?

The T accounts themselves are not part of the double entry bookkeeping system, and are not used to maintain the bookkeeping records of a business. You do not have to use T accounts, but they are an aid to working out what the accounting entries are before producing a journal entry. And as you’re issuing sales invoices, making payments, receiving revenue, Deskera automatically debits and credits the transaction values into the corresponding ledger accounts. The credits and debits are recorded in a general ledger, where all account balances must match. The visual appearance of the ledger journal of individual accounts resembles a T-shape, hence why a ledger account is also called a T-account.

When Cash Is Debited and Credited

A balance sheet is a summary of a company’s financial position at a given point in time. The balance sheet summarizes the financial position of the company at the end of a specific period, usually at the end of the fiscal year. It is used transfer pricing by stakeholders to evaluate a company’s financial strength and to make investment decisions. The T-account is a quick way to work out the placement of debits/credits before it’s recorded in full detail to help avoid data entry errors.

I liked seeing how curious they were about the world and being able to push them toward that curiosity. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. When inventory items are acquired or produced at varying costs, the company will need to make an assumption on how to flow the changing costs.

Here’s an example of how each T-account is structured in the accounting equation. Ledger accounts use the T-account format to display the balances in each account. Each journal entry is transferred from the general journal to the corresponding T-account. The debits are always transferred to the left side and the credits are always transferred to the right side of T-accounts. A T-account helps people understand how money in accounting moves in and out.

In order to keep track of transactions, I like to number each journal entry as its debit and credit is added to the T-accounts. This way you can trace each balance back to the journal entry in the general journal if you have any questions later in the accounting cycle. Since most accounts will be affected by multiple journal entries and transactions, there are usually several numbers in both the debit and credit columns. Account balances are always calculated at the bottom of each T-account. The total difference between the debit and credit columns will be displayed on the bottom of the corresponding side. In other words, an account with a credit balance will have a total on the bottom of the right side of the account.

Revenue also increases, so the Repair Service Revenue account gets credited for $600. Because cash is an asset account, the Cash account will be debited for $20,000. And if you’re new to the accounting world and have little knowledge in finance, T accounts can be especially useful in working through complex financial transactions. The use and purpose of a T account is to help business owners visualize the amounts on each individual account. Splitting out debits and credits makes it easier to quickly spot things when looking at the ledger. In double-entry bookkeeping, every transaction affects two accounts at the same time (hence the word double).