Invoice Guide: Definition, Examples, What to include

Additionally, invoices can help you protect your company during an audit, as they establish a paper trail. Detailed invoices will show the taxation department in your country exactly where your money came from, should they question your tax returns. There’s a good selection of simple invoice templates for both Google Doc and Google Sheets available from Invoice cares act 401k withdrawal rules Simple. Once you open the invoice you’d like to use, just go to File and select “Make a copy…” to create a copy you can edit. Even if you’re sending the invoice by email, you should try to include postal addresses. If your client needs to mail you a physical copy of a tax form (Form 1099 MISC, for instance), this will make things easier for them.

common types of invoices

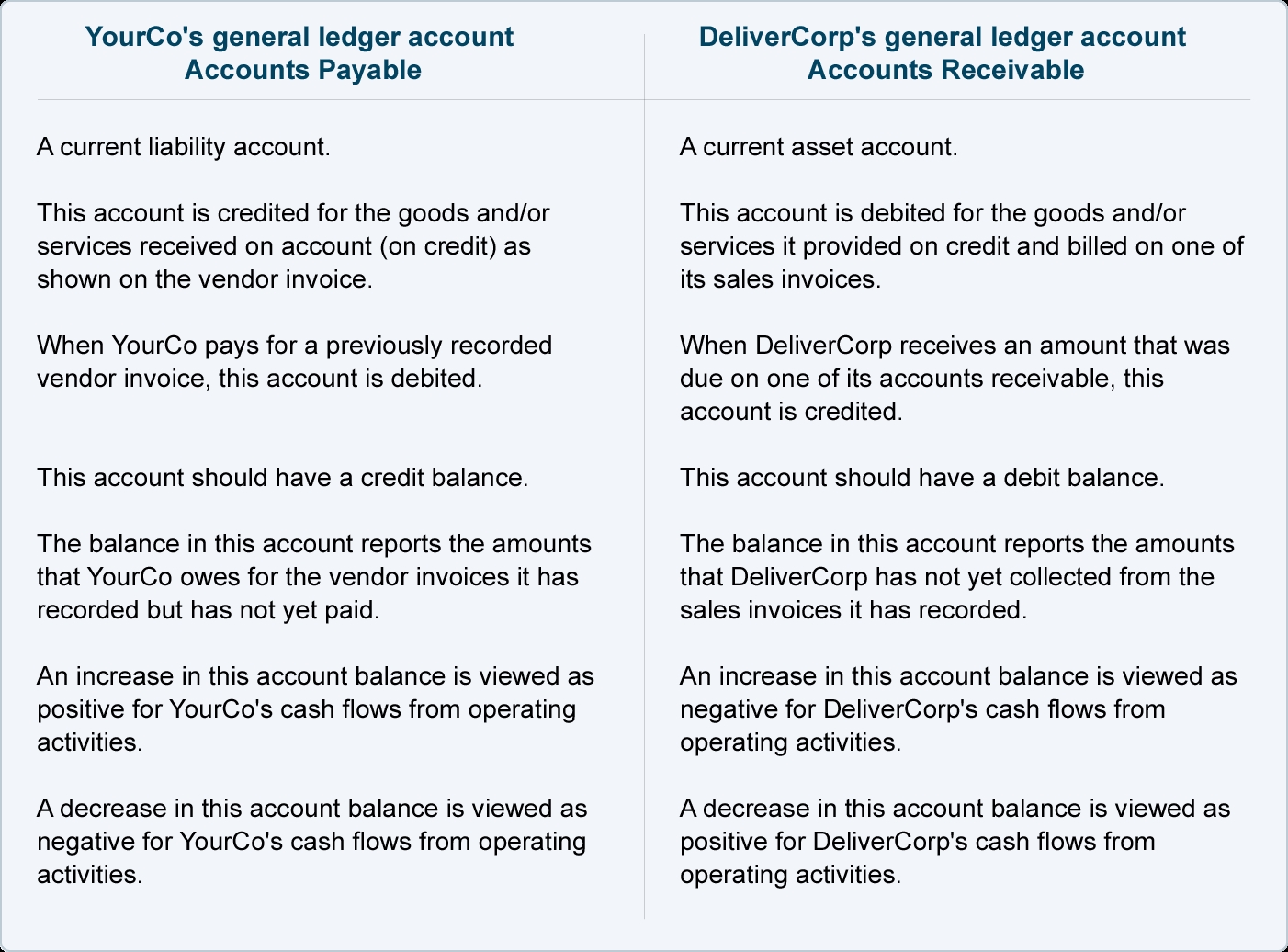

If you’re selling to a business, the invoiced amount gets entered as accounts payable on their end—money coming out of their pocket. For your bookkeeping, it becomes an item in your accounts receivable—money going into your pocket. Are you looking for design tips to help you create professional-looking electronic invoices that stand out? There are several types of invoices, each with its own specific application in the business world. Some companies may only use one or two of these invoice variants, while others might use nearly all of them on a recurring invoice basis.

Company name and address

Several e-invoicing standards, such as EDIFACT and UBL, have been developed around to world to facilitate adoption and efficiency. Electronic records also allow you to search and sort transactions easier by number, date, goods, or client. The invoice normally lists the goods or services supplied to the customer and must include the total amount and any necessary taxes.

- Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

- Proper invoicing practices are essential for managing accounts receivable and maintaining healthy cash flow within businesses.

- Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- Understanding the various elements of an invoice is essential for the proper execution of a transaction.

- Depending on the template you use, it may also include a due date for payment.

How to Send an Invoice

Otherwise, an invoicing software—such as FreshBooks—may be a better choice. With this method, you can use a software template—in Microsoft Word or Excel, for example—each time you send an invoice. These templates are easy to use, but look like professional invoices. You can either attach the invoice to an email, or print it out and send a physical copy. Understanding the details of the invoicing process—and developing your own invoicing system—is essential to running a successful business.

Pro forma invoice

You may also choose to collect half of the payment upfront, collect partial payments over time, or require immediate payment upon completion. When issuing an invoice, you should enter every product or service you provide, along with the price and quantity for each, as a line item. At the bottom of the invoice, add up all of the line items, and apply any tax charges.

When customers receive it, they refer to it as a bill they need to pay. Invoices make a record of all your sales and so are helpful for bookkeeping purposes. Invoices are invoice documents that provide documentation of your business’s financial history. They track all the revenue from your business through sales and can help you gauge your profits and cash flow. Invoicing demonstrates a client’s obligation to pay for your goods or services.

Businesses must create physical or electronic invoices to ensure their accounts receivable department receives customer payment. Invoices serve as legally enforceable agreements between a company and its client, helping you track your sales and manage your cash flow. In accounting, an invoice is a document that records a transaction between a vendor and a buyer, itemizing the products or services delivered and the payment terms.

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution.

Another user is the seller, which uses the invoice as a source document to prove that sales transactions have been created. The total of all invoices issued, less any credit memos, will sum to the credit sales total for the seller’s reporting period. Since invoices record the sales you’ve made, they contain key information such as unit prices of goods or services, the total amounts and dates of transactions that happened, and so on.